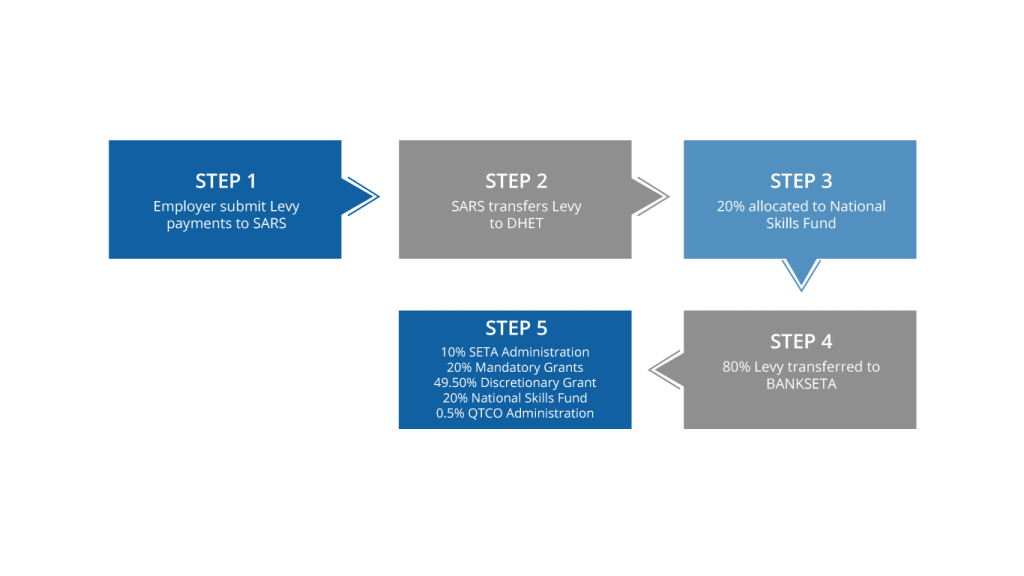

This payable levy came into effect as of 1 April 2000. The Department of Higher Education and Training, in conjunction with various SETAs, is responsible for administering this Act, with the South African Revenue Service (SARS) collecting all levies.

- 7:30 am to 4:00 pm (Mon_Fri)

- Building 2, Waterfall Corporate Campus,

- View On Map

-

Mail Us On

callcentre@sasseta.org.za

-

Make a Call

011 087 5555

- View On Map

- 7:30 am to 4:00 pm (Mon_Fri)

- Building 2, Waterfall Corporate Campus,

- View On Map

-

Mail Us On

callcentre@sasseta.org.za

-

Make a Call

011 087 5555

- STAKEHOLDER SYSTEM